Good morning. The Fed must choose between two unpleasant options today. It’s a reminder of the high cost of weak bank oversight.

The Federal Reserve building. Haiyun Jiang/The New York Times

Inflation — or turmoil?

The Federal Reserve faces a difficult decision at its meeting that ends this afternoon: Should Fed officials raise interest rates in response to worrisome recent inflation data — and accept the risk of causing further problems for banks? Or should officials pause their rate increases — and accept the risk that inflation will remain high?

This dilemma is another reminder of the broad economic damage that banking crises cause. In today’s newsletter, I’ll first explain the Fed’s tough call and then look at one of the lessons emerging from the current banking turmoil. Above all, that turmoil is a reminder of the high costs of ineffective bank regulation, which has been a recurring problem in the U.S.

The Fed’s dilemma

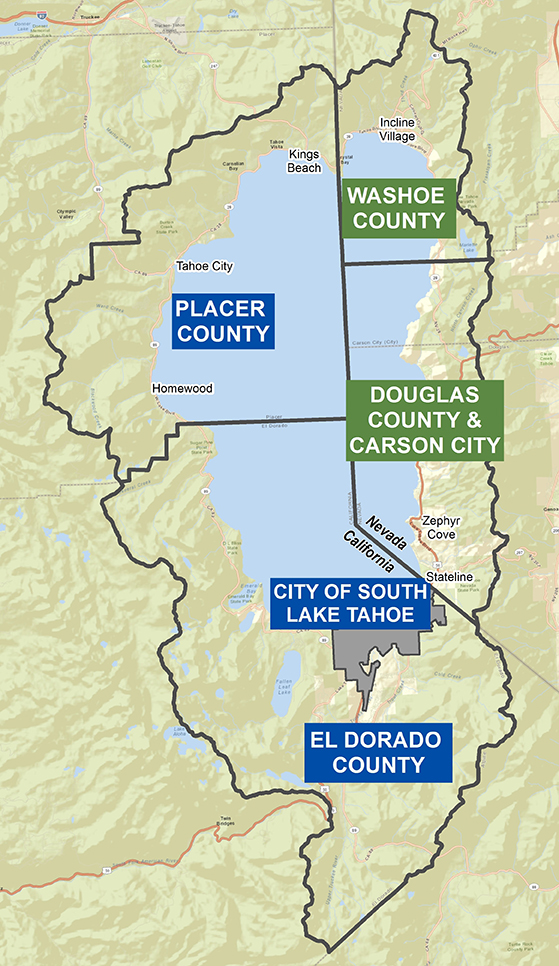

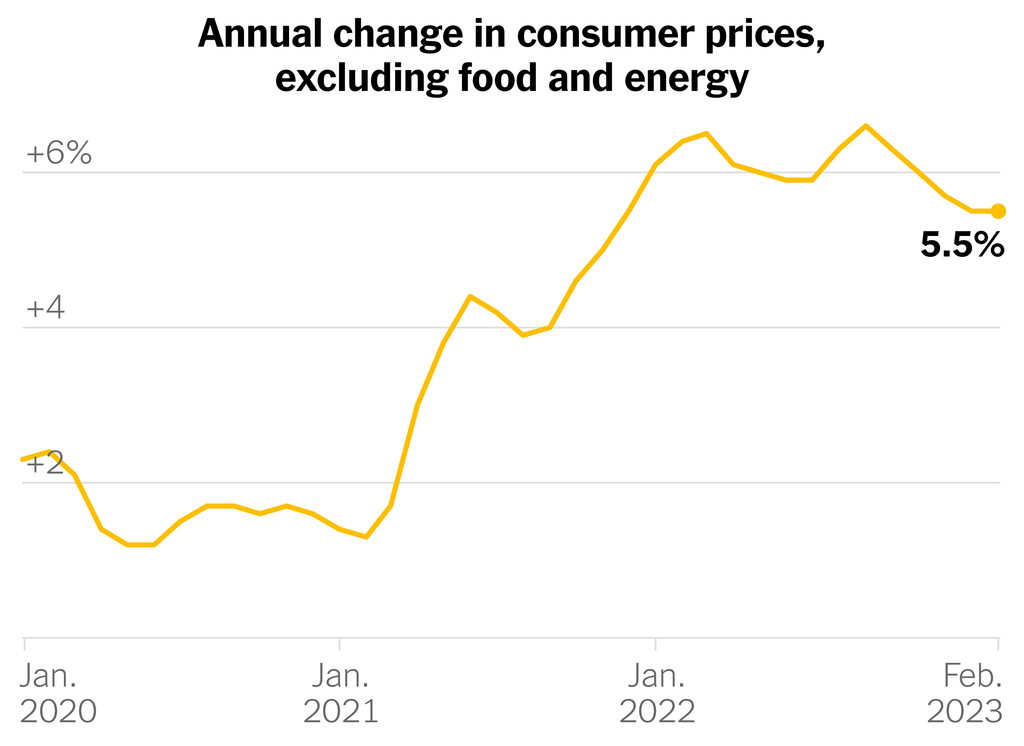

The trouble for the Fed is that there are excellent reasons for it to continue raising interest rates and excellent reasons for it to take a break. On the one hand, the economic data in recent weeks has suggested that inflation is not falling as rapidly as analysts expected. Average consumer prices are about 6 percent higher than a year ago, and forecasters expect the figure to remain above 3 percent for most of this year. That’s higher than Fed officials and many families find comfortable. For much of the 21st century, inflation has been closer to 2 percent.

An inflation rate that remains near 4 percent for an extended period is problematic for several reasons. It cuts into buying power and gives people reason to expect that inflation may stay high for years. They will then ask their employers for higher wages, potentially causing a spiral in which companies increase their prices to pay for the raises and inflation drifts even higher. Today’s tight job market, with unemployment near its lowest level since the 1960s, adds to these risks. The economy still seems to be running hotter than is sustainable.

This situation explains why Fed officials had originally planned to continue raising their benchmark interest rate at today’s meeting — thereby slowing the economy by increasing the cost of homes, cars and other items that people buy with debt. Some Fed officials favored a quarter-point increase, which would be identical to the increase at the Fed’s meeting last month. Others preferred a half-point increase, in response to the worrisome recent inflation data.

The banking troubles of the past two weeks scrambled these plans. Why? In addition to slowing the economy, higher interest rates depress the value of many financial assets (as these charts explain). Some bank executives did a poor job planning for these asset declines, and their balance sheets suffered. When customers became worried that the banks would no longer have enough money to return their deposits, a classic bank run ensued. It led to the collapse of Silicon Valley Bank and Signature Bank, and others remain in jeopardy.

If Fed officials continue raising their benchmark rate, they risk damaging the balance sheets of more banks and causing new bank runs. That’s why a half-point increase now seems less likely. Some economists (including The Times’s Paul Krugman) have urged the Fed to avoid any additional increases for now. Many analysts expect the Fed will compromise and raise the rate by a quarter point; Jason Furman, a former Obama administration official, leans toward that approach.

The decision is unavoidably fraught. The Fed must choose between potentially exacerbating problems in the financial markets and seeming to go soft on inflation.

Why bailouts happen

All of which underscores the high cost of banking crises. In most industries, a company’s collapse doesn’t cause cascading economic problems. In the financial markets, the collapse of one firm can lead to a panic that feeds on itself. Investors and clients start withdrawing their money. A recession, or even a depression, can follow.

These consequences are the reason that government officials bail out banks more frequently than other businesses. Bailouts, of course, have huge downsides: They typically use taxpayer money (or other banks’ money) to subsidize affluent bank executives who failed at their jobs. “Nobody is as privileged in the entire economy,” Anat Admati, a finance professor at Stanford University’s business school, told me.

During a crisis, bailouts can be unavoidable because of the economic risks from bank collapses. The key question, then, is how to regulate banks rigorously enough to minimize the number of necessary bailouts.

Over the past few decades, the U.S. has failed to do so. After the financial crisis of 2007-9, policymakers tightened the rules through the Dodd-Frank Act. But Congress and the Trump administration loosened oversight for midsize banks in 2018 — and Silicon Valley Bank and Signature Bank were two of the firms that stood to benefit.

As complicated as finance can be, the basic principles behind bank regulation are straightforward. Banks require special scrutiny from the government because they may receive special benefits from taxpayers during a crisis. This scrutiny includes limits on the risks that banks can take and requirements that they keep enough money in reserve to survive most foreseeable crises. “You make sure they have enough to pay,” as Admati put it.

Bank executives and investors often bristle at such rules because they reduce returns. Money held in reserve, after all, cannot be invested elsewhere and earn big profits. It also can’t go poof when hard times arrive.